Today was a test of patience - the funny market just did not move for a long time. But

the only reason that it was such a test is because I was at the terminal all

the time... With mechanical trading systems, it might be better to

ignore the terminal the majority of the time. There's nothing much to be

done sitting there - everything is pre-decided.

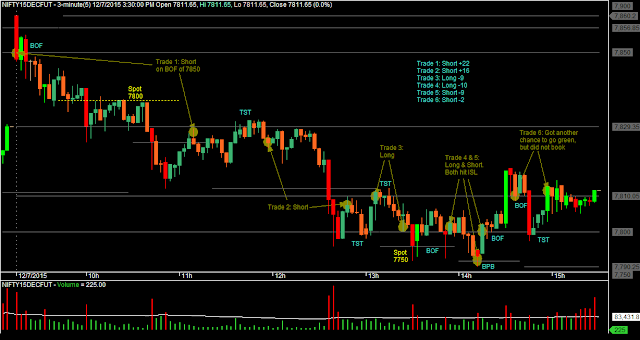

Do the trades look stupid? Well, they were pre-decided to be that. That doesn't mean that the system is stupid. It's just mechanical. It doesn't use its brain in real time.

Will the trades look stupid over the long term? Well, if that's the case, then the system is stupid... like the brain behind it... it's early days to judge ☢

This December has been pretty bad for me.... Early days with my new SAR system. Hoping that Yuletide ☃ brings happy tidings.

Do the trades look stupid? Well, they were pre-decided to be that. That doesn't mean that the system is stupid. It's just mechanical. It doesn't use its brain in real time.

Will the trades look stupid over the long term? Well, if that's the case, then the system is stupid... like the brain behind it... it's early days to judge ☢

This December has been pretty bad for me.... Early days with my new SAR system. Hoping that Yuletide ☃ brings happy tidings.