This is an analysis of the Optimal Risk for my y48 system trades, calculated as per the Kelly Criterion.

I have been trading the y48 Trading System since May 28th. The details and statistics of the y48 trades are available on my Trading Stats page.

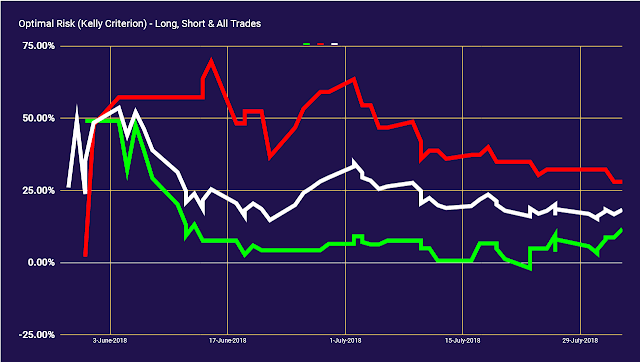

The chart below shows the continuously calculated values of Optimal Risk based on actual trades. There are 3 lines:

The Optimal Risk as per Kelly Criterion is calculated based on 2 parameters - the Win Rate, and the Payoff Ratio. The Optimal Risk is percentage of capital to be risked to maximize capital gain. I had posted earlier about the Kelly Criterion.

The continuously calculated value of the Optimal Risk has varied drastically since May 28, as seen in the chart.

So, as of today, if I expect the performance of the y48 trading system to remain the same as since May 28, I should optimally be risking 18.35% of my capital in each trade. Ideally, if I had risked this Optimal Fraction for all my 64 trades from May 28 to Aug 03, with a 50% Win Rate and Payoff Ratio of 1.58, my Return on Capital would have been 426%.

Even better, if I had risked 11.69% of my capital on each long trade, and 28% of my capital in each short trade. So, if I had risked accordingly on the 37 long trades and 27 short trades done between May 28 and Aug 03, and assuming that the win rate and payoff ratio would have remained the same for the longs and shorts, my Return on Capital would have been 504%.

y48 is just an average trading system - profitable, but nowhere close to some of the better trading systems. However, when boosted by the steroid of Kelly Criterion, even an average trading system can give superlative returns. Are you ready to ride the highs (and the lows)?

Well, my returns with the y48 system have not been as good.... but though considerably lower, they have been very very good. That is because, I obviously did not risk this exact calculated percentage of my capital (obvious, since it is a hindsight calculation). Also, I did not actually compound my capital, since I use a slightly mellower version of Money Management. And, there is small matter that I have not considered brokerage and other costs for these calculations. Those costs would have brought down the value of Optimal Risk by a couple of percentages.

I actually risked between 15% to 35% of my ledger balance in each trade. My ledger balance is just one part of what I define as my trading capital. Currently, I work out my the balance to be held in my ledger based on a convoluted formula that also considers my total liquid funds. That really takes the edge off the Steroid - it mellows of the effect of Kelly Criterion to a tolerable level. But more on that later.....

I have been trading the y48 Trading System since May 28th. The details and statistics of the y48 trades are available on my Trading Stats page.

The chart below shows the continuously calculated values of Optimal Risk based on actual trades. There are 3 lines:

- The Green Line shows how the Optimal Risk varied for Long Trades.

- The Red Line shows how the Optimal Risk varied for Short Trades.

- The White Line shows how the Optimal Risk varied for All Trades - both Long and Short.

|

| Optimal Risk as per Kelly Criterion |

The Optimal Risk as per Kelly Criterion is calculated based on 2 parameters - the Win Rate, and the Payoff Ratio. The Optimal Risk is percentage of capital to be risked to maximize capital gain. I had posted earlier about the Kelly Criterion.

The continuously calculated value of the Optimal Risk has varied drastically since May 28, as seen in the chart.

| Maximum Value |

Minimum Value |

Last Value |

|

|---|---|---|---|

| Long Trades |

49.07% May 31 |

-1.92% Jul 23 |

11.69% Aug 03 |

| Short Trades |

69.65% Jun 15 |

2.10% May 31 |

28.00% Aug 03 |

| All Trades |

53.61% Jun 04 |

14.76% Jun 22 |

18.35% Aug 03 |

So, as of today, if I expect the performance of the y48 trading system to remain the same as since May 28, I should optimally be risking 18.35% of my capital in each trade. Ideally, if I had risked this Optimal Fraction for all my 64 trades from May 28 to Aug 03, with a 50% Win Rate and Payoff Ratio of 1.58, my Return on Capital would have been 426%.

Even better, if I had risked 11.69% of my capital on each long trade, and 28% of my capital in each short trade. So, if I had risked accordingly on the 37 long trades and 27 short trades done between May 28 and Aug 03, and assuming that the win rate and payoff ratio would have remained the same for the longs and shorts, my Return on Capital would have been 504%.

y48 is just an average trading system - profitable, but nowhere close to some of the better trading systems. However, when boosted by the steroid of Kelly Criterion, even an average trading system can give superlative returns. Are you ready to ride the highs (and the lows)?

Well, my returns with the y48 system have not been as good.... but though considerably lower, they have been very very good. That is because, I obviously did not risk this exact calculated percentage of my capital (obvious, since it is a hindsight calculation). Also, I did not actually compound my capital, since I use a slightly mellower version of Money Management. And, there is small matter that I have not considered brokerage and other costs for these calculations. Those costs would have brought down the value of Optimal Risk by a couple of percentages.

I actually risked between 15% to 35% of my ledger balance in each trade. My ledger balance is just one part of what I define as my trading capital. Currently, I work out my the balance to be held in my ledger based on a convoluted formula that also considers my total liquid funds. That really takes the edge off the Steroid - it mellows of the effect of Kelly Criterion to a tolerable level. But more on that later.....