Well, nothing is free, but this is a setup with a very low risk of losing money. Nifty Index is currently (July 14 EOD) at 8565. The derivative premiums are ridiculously bullish. 9000 deep in-the-money (ITM) Puts have almost nil Theta (time value).

|

| Nifty Option Chain - Strike Price 9000 |

December 2016 8500 and 9000 strikes are liquid at the moment. It is time to buy the December deep ITM strikes.

|

| Nifty Option Chain - December |

Near month at-the-money (ATM) or nearby strikes can be sold again and again. You have time until December to own a free 9000 put. If the price, moves to 9000, the 9000 December Put will still be above 200 - see the current price of 8500 December Put, but the near month puts will lose value. Even if the price moves down, the December deep ITM Puts will have a higher Delta than near month ATM puts. And you can always roll over the near month to the next month.

|

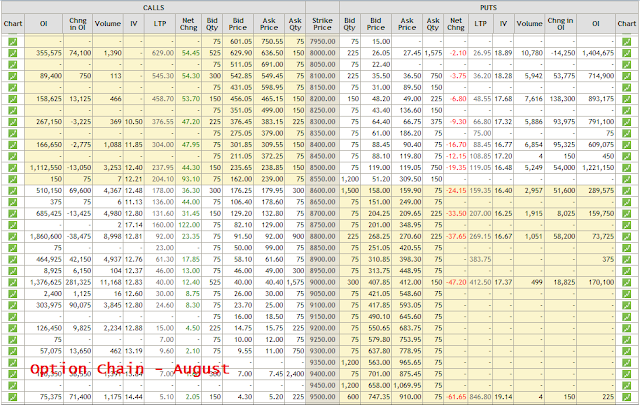

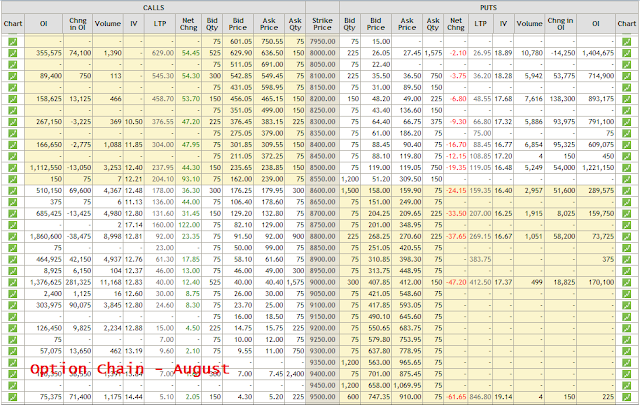

| Nifty Option Chain - July |

|

| Nifty Option Chain - August |

And given the crazy premiums on the Call side, if you want to play a Calendar Spread, you should buy the near month Calls and sell the far month Calls. Markets are about to open, so posting this in a hurry....

Also read:

Super Stupid Option Premium Skew