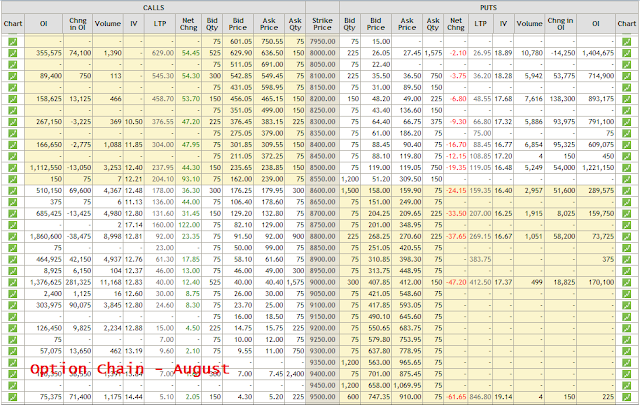

Now, this is irritating. Nifty Spot closed at ₹8090.95, and Nifty November Futures closed at ₹8075.25. Now, December 2017 Nifty 9000 Call that is ₹909 OTM is available at around ₹337, and December 2017 Nifty 8000 Put that is ₹91 OTM is available at around ₹338. Why is a ₹909 OTM option and a ₹91 OTM option available at the same price?

These LEAPS options do have sufficient market depth to allow accumulation.

I might be wrong, but I think that 8000 is considerably closer to the the current Nifty Spot Price than 9000. Do the big option players think differently? Why is there a persistent skew overpricing Calls in comparison to Puts? What am I missing?

Isn't there free money here, like I have posted about the Premium Skew in July this year? I have been periodically observing the Premium Skew, for at least 3 years now. I had even attempted to trade it once, but got bored after a couple of months (See my post in Traderji about it). I just don't have the patience needed to pull it off. Maybe, it does not match my temperament, or maybe it is just that I don't have sufficient capital to make a big killing on it, or maybe it's just that I have got better stuff to do ☺

Or, maybe I just don't understand this stuff at all. Such is life.... Skew my life!!

| Nifty December 2017 9000 Call - ₹909 OTM for ₹337 |

| Nifty December 2017 8000 Put - ₹91 OTM for ₹338 |

These LEAPS options do have sufficient market depth to allow accumulation.

I might be wrong, but I think that 8000 is considerably closer to the the current Nifty Spot Price than 9000. Do the big option players think differently? Why is there a persistent skew overpricing Calls in comparison to Puts? What am I missing?

Isn't there free money here, like I have posted about the Premium Skew in July this year? I have been periodically observing the Premium Skew, for at least 3 years now. I had even attempted to trade it once, but got bored after a couple of months (See my post in Traderji about it). I just don't have the patience needed to pull it off. Maybe, it does not match my temperament, or maybe it is just that I don't have sufficient capital to make a big killing on it, or maybe it's just that I have got better stuff to do ☺

Or, maybe I just don't understand this stuff at all. Such is life.... Skew my life!!