Today was a test of patience - the funny market just did not move for a long time. But

the only reason that it was such a test is because I was at the terminal all

the time... With mechanical trading systems, it might be better to

ignore the terminal the majority of the time. There's nothing much to be

done sitting there - everything is pre-decided.

Do the trades look stupid? Well, they were pre-decided to be that. That doesn't mean that the system is stupid. It's just mechanical. It doesn't use its brain in real time.

Will the trades look stupid over the long term? Well, if that's the case, then the system is stupid... like the brain behind it... it's early days to judge ☢

This December has been pretty bad for me.... Early days with my new SAR system. Hoping that Yuletide ☃ brings happy tidings.

Thursday, December 24, 2015

Wednesday, December 23, 2015

20151223 - Yawn! Boring Day

Nothing to write about today. A gap up, then continued the momentum for about an hour, and then just ranged for the rest of the day.

Tuesday, December 22, 2015

20151222 - Some wind in the sail...

So, here comes a small break in my losing saga....

The first trade was a slow moving one, but there was some wind in the sail with the second one.

Lazy day... had nothing much to do. That's an advantage of mechanical trading systems (on some days ☺).

The first trade was a slow moving one, but there was some wind in the sail with the second one.

Lazy day... had nothing much to do. That's an advantage of mechanical trading systems (on some days ☺).

Monday, December 21, 2015

20151221 - Default behavior

Today, I had a simple but tough-to-implement plan. But early on, when I did not get any entry signal with the plan, I fell back into my default behavior. My default behavior is find a set of rules that have a statistical or visual +ve expectancy, and trade it mechanically to death. Then when a whipsaw occurs, I begin the process all over again.

Today, I traded the "fewer trade" variation of the SAR system that I used on Friday, which meant that I missed the opening move.

Today, I traded the "fewer trade" variation of the SAR system that I used on Friday, which meant that I missed the opening move.

Friday, December 18, 2015

20151218 - The Casino Effect

Today, I was busy with other stuff. Fully aware of the risks involved in mechanically trading SAR without being at terminal, I decided to play it with one lot....

There were 2 versions of this SAR system - one that trades more being SAR all the time, and the other that trades less by not being in trade all the time. Both are good and profitable over the LOOONG term. I chose the first one today. Today, was not the day. Even with 1 lot, it's a big loss.

I have tested n number of mechanical systems. Many of them are very profitable over the LOOONG term, but the drawdowns are severe (also when compared to discretionary systems). They have to be played for the long term, but the drawdowns limit the margins that can be utilized, and ultimately the returns for these systems.

So, until that series of big wins start pouring in with these systems, I trade with hope of that happening, just like in casinos. And when the series of big wins happen, margin utilization is increased, in the excitement of it all. Bet big until all is lost. Just like in casinos. End result: The system remains profitable in all backtests, not me.

There is no way that I cannot acknowledge that I have a problem to solve... What will I do about it? TBD.

There were 2 versions of this SAR system - one that trades more being SAR all the time, and the other that trades less by not being in trade all the time. Both are good and profitable over the LOOONG term. I chose the first one today. Today, was not the day. Even with 1 lot, it's a big loss.

I have tested n number of mechanical systems. Many of them are very profitable over the LOOONG term, but the drawdowns are severe (also when compared to discretionary systems). They have to be played for the long term, but the drawdowns limit the margins that can be utilized, and ultimately the returns for these systems.

So, until that series of big wins start pouring in with these systems, I trade with hope of that happening, just like in casinos. And when the series of big wins happen, margin utilization is increased, in the excitement of it all. Bet big until all is lost. Just like in casinos. End result: The system remains profitable in all backtests, not me.

There is no way that I cannot acknowledge that I have a problem to solve... What will I do about it? TBD.

Thursday, December 17, 2015

20151217 - Stayed out of the Chop... Missed the Fluid

Just one of those days.... that seems to happen to me daily. I got excuses for everything...

Day started off with a BOF of 7800. I thought about taking it, but then decided to wait. Then I watched it making lower highs.

Trade 1 was a long on BOF of 7750. Price chopped around, but I managed to stay out of the chop. As market broke out of chop, I anticipated that it would come back in range and shorted (Trade 2). It was a wrong guess, so I reversed to long again (Trade 3). I tightened the Stop just to allow the market to take it (actually, I didn't want a bigger loss). My SL was 7768.50, and price dipped to EXACTLY that before zooming up.

I watched it zoom, but I was not done yet. There was an inside bar at the morning high 7810, and I tried to short it. Luckily, the trade missed me :) It would have been a good pullback trade, if I had thought long.

The last trade was done hoping that the market had run out of steam, as happens on some days towards the end of day. I had no clue about why price zoomed up, until the EOD, I looked up the news to find that it's something to do with yesterday's Fed rate hike, that Indian markets didn't know what to do about until the European markets started moving.

Today, I went a step ahead, and broadcast my trades even before taking them. Whether I am doing good at my trading or not, I am doing better at broadcasting it. All my live tweets are on the Twitter widget on the right pane of the web page. Have a look...

Here's a zoomed-in image of the whipsaw, that is not clear on the chart above.

Day started off with a BOF of 7800. I thought about taking it, but then decided to wait. Then I watched it making lower highs.

Trade 1 was a long on BOF of 7750. Price chopped around, but I managed to stay out of the chop. As market broke out of chop, I anticipated that it would come back in range and shorted (Trade 2). It was a wrong guess, so I reversed to long again (Trade 3). I tightened the Stop just to allow the market to take it (actually, I didn't want a bigger loss). My SL was 7768.50, and price dipped to EXACTLY that before zooming up.

I watched it zoom, but I was not done yet. There was an inside bar at the morning high 7810, and I tried to short it. Luckily, the trade missed me :) It would have been a good pullback trade, if I had thought long.

The last trade was done hoping that the market had run out of steam, as happens on some days towards the end of day. I had no clue about why price zoomed up, until the EOD, I looked up the news to find that it's something to do with yesterday's Fed rate hike, that Indian markets didn't know what to do about until the European markets started moving.

Today, I went a step ahead, and broadcast my trades even before taking them. Whether I am doing good at my trading or not, I am doing better at broadcasting it. All my live tweets are on the Twitter widget on the right pane of the web page. Have a look...

Here's a zoomed-in image of the whipsaw, that is not clear on the chart above.

Wednesday, December 16, 2015

20151216 - Buying Tops and Selling Bottoms

Finally, after many days, I got the time to sit in front of the terminal... but it was not a good time. ☹

All 3 trades were losers.

Trade 1 was taken on the low of the second M15 bar - which was an inside bar - in the hope of a down move. Trade 2 was taken on the hope of a breakout move. For this trade, I should perhaps have tightened the SL, maybe? Trade 3 was BOF of HOD. Got shaken out.

All the hoping was hopeless. All I was doing today was buying tops and selling bottoms.

All 3 trades were losers.

Trade 1 was taken on the low of the second M15 bar - which was an inside bar - in the hope of a down move. Trade 2 was taken on the hope of a breakout move. For this trade, I should perhaps have tightened the SL, maybe? Trade 3 was BOF of HOD. Got shaken out.

All the hoping was hopeless. All I was doing today was buying tops and selling bottoms.

Friday, December 11, 2015

20151211 - Nothing goes right

I was a bit over-patient in the morning, then impatient in the second half. Nothing is going right for me.... Analysis time.

I have not updated the Trading Stats since yesterday. I will get around to that later. When you keep on losing, everything else seems a futile exercise.

I have not updated the Trading Stats since yesterday. I will get around to that later. When you keep on losing, everything else seems a futile exercise.

Thursday, December 10, 2015

Time to take a break

Time to take a break from trading and analyze. next update only after that.

https://t.co/SWTAnsvfCz #NIFTY #Daytrading #TechnicalAnalysis

— Bakwaas Trading (@BakwaasTrading) December 10, 2015Wednesday, December 9, 2015

20151209 - Back on familiar (mechanical) turf

In the morning, did 2 discretionary trades. Pretty bad trades. Seemed I am not in sync with the market (surprising!), so I switched to mechanical trades. Those didn't work out either. I had MFE of +19 and +20 on the mechanical trades, but the mechanical rules did not permit me to book.... The other reason for switching to mechanical is that I am not able to spend much in front of the terminal this week, due to some other work.

Kinda stupid to log losses and broadcast to the world, but I have decided to continue this for at least this month. Let's see.... Tomorrow is another day...

Kinda stupid to log losses and broadcast to the world, but I have decided to continue this for at least this month. Let's see.... Tomorrow is another day...

Tuesday, December 8, 2015

20151208 - Making bad luck out of good luck

From 11 AM onward, I was hardly available at the terminal today. I traded despite that. You could say that I was trading blind. For all my exertions, all I got is the usual downer. I got 11 points from 5 trades today +15, -7, +1, -4 and +6. Yesterday, I had 8 points from 6 trades. *All pre-brokerage points

Trade 1 exit was unlucky. The SL hit when I was away from the terminal.

I was also away when the Trade 2 entry happened. Was lucky to have been able to exit (SAR), just before the spike up. Then, I lost an opportunity to lock few points in Trade 3.

Trades 4 and 5, that happened during the last hour fall, were worse - they resulted from typos. My fingers ☹ slipped on the keyboard or something .... I don't know what happened, I was not focused. I clicked something on my keyboard, and thought that I had gone long at 7755, when in reality it was the exit from a short position that I had created without even realizing it (maybe from another typo...). So, when I thought I was exiting my long at 7746, I was actually creating a new short position. Then, just as I was about to close the terminal, I realized that I was short, and placed a tight SL which got hit. Which means that I had the good luck of being short twice in the fall with small risk (without even realizing it), and the bad luck of exiting those positions for nothing. Confusing? Sure, even I deciphered these trades only after EOD.

All of this was updated live on my twitter timeline - available on the right panel of this web page.

Since I shifted to discretionary trading this month, I have not had any big losses. So, I will keep playing this system, though the System Hopping itch is creeping in.

Trade 1 exit was unlucky. The SL hit when I was away from the terminal.

I was also away when the Trade 2 entry happened. Was lucky to have been able to exit (SAR), just before the spike up. Then, I lost an opportunity to lock few points in Trade 3.

Trades 4 and 5, that happened during the last hour fall, were worse - they resulted from typos. My fingers ☹ slipped on the keyboard or something .... I don't know what happened, I was not focused. I clicked something on my keyboard, and thought that I had gone long at 7755, when in reality it was the exit from a short position that I had created without even realizing it (maybe from another typo...). So, when I thought I was exiting my long at 7746, I was actually creating a new short position. Then, just as I was about to close the terminal, I realized that I was short, and placed a tight SL which got hit. Which means that I had the good luck of being short twice in the fall with small risk (without even realizing it), and the bad luck of exiting those positions for nothing. Confusing? Sure, even I deciphered these trades only after EOD.

All of this was updated live on my twitter timeline - available on the right panel of this web page.

Since I shifted to discretionary trading this month, I have not had any big losses. So, I will keep playing this system, though the System Hopping itch is creeping in.

Monday, December 7, 2015

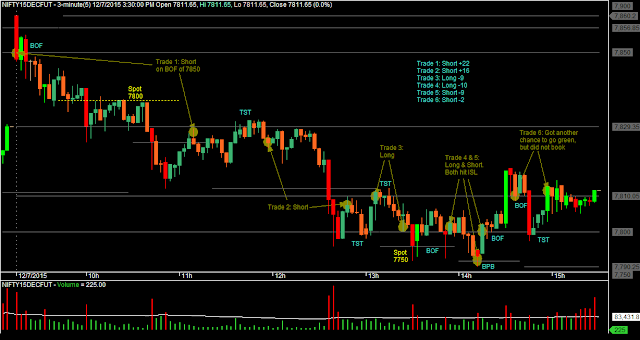

20151207 - Too many hasty entries today

Today was going well with decent wins in the first half, but turned a disaster with a string of losses in the second half. At the end of the day, I got nothing.

Many of the entries were hasty, I guess, though I am not sure. To a large extent, I tried to base my entries on the Decision Point Trading method that is explained on the Nifty Nirvana blog (link to download the free e-book on that site), but I am not doing it right.... The author does not take as many entries as I do.

Other than the entries, the rest of my trading today was mechanical trailing. One of my issues with discretionary trading is that I never know whether I did it right or wrong, which is almost what these methods are, by definition.

Again, I did not trail SL early, because that was my mechanical rule for the day. If I had trailed early, I would have lost less in the losing trades, but then Trade 2 would also have been a loss....

Many of the entries were hasty, I guess, though I am not sure. To a large extent, I tried to base my entries on the Decision Point Trading method that is explained on the Nifty Nirvana blog (link to download the free e-book on that site), but I am not doing it right.... The author does not take as many entries as I do.

Other than the entries, the rest of my trading today was mechanical trailing. One of my issues with discretionary trading is that I never know whether I did it right or wrong, which is almost what these methods are, by definition.

Again, I did not trail SL early, because that was my mechanical rule for the day. If I had trailed early, I would have lost less in the losing trades, but then Trade 2 would also have been a loss....

Friday, December 4, 2015

20151204 - Down Day

Yesterday, I thought that I was intelligent. Today, I longer have that pretension. Yesterday, I talked about having low MAE's - but today, the MFE's were low, except for the 4th trade. The MFE's for the 5 trades done today were +0.15, +4.00, +1.50, +29.45 and +6.50

Some of my entries were perhaps a bit hasty. As usual, such facts are always much clearer at the end of the day.

Some of my entries were perhaps a bit hasty. As usual, such facts are always much clearer at the end of the day.

Thursday, December 3, 2015

20151203 - Finally, a decent profit day after a long time!!

Today was a good day, or as I call it - a lucky day. 3 trades, and I think all of them were good. Profit taking - something that I can always complain about - not too bad.

The last 2 trades zoomed into profit, so there was not much to do on those. One took an hour for 17 points, and the other 45 minutes for 48 points. The first trade took 2 hours and 45 minutes for a small loss. That one was more tricky than the others, and I had marked a channel for Price to move along, but it deviated and fell down and had to get up all over again ☺. Note that I could have locked in a small profit on it anytime, but I chose to be wiser (or sillier) - I don't know which was it.

My last 6 trades have been: +15, +9, +12, -1, +17 and +48. That's good, but what I am really happy about is the MAE's on these trades. Those are 0.00, 0.00, -0.60, -2.60, -2.55 and -2.20 ☻. Am I intelligent or what?

MAE = Most Adverse Excursion

The last 2 trades zoomed into profit, so there was not much to do on those. One took an hour for 17 points, and the other 45 minutes for 48 points. The first trade took 2 hours and 45 minutes for a small loss. That one was more tricky than the others, and I had marked a channel for Price to move along, but it deviated and fell down and had to get up all over again ☺. Note that I could have locked in a small profit on it anytime, but I chose to be wiser (or sillier) - I don't know which was it.

My last 6 trades have been: +15, +9, +12, -1, +17 and +48. That's good, but what I am really happy about is the MAE's on these trades. Those are 0.00, 0.00, -0.60, -2.60, -2.55 and -2.20 ☻. Am I intelligent or what?

MAE = Most Adverse Excursion

Wednesday, December 2, 2015

20151202 - A dim light... could have been brighter

Finally, a small profit... but could have been better.

Trade 1 was a bad exit... as happens always. My Initial SL was at Day High, but I moved it to the next bar high. Price came up to eat my SL, did not even touch Day High, and fell down. I thought of reentering short at 7995, but then decided that it would be overkill. If I had been in that trade, the light would have been brighter....

Otherwise, after 2 losses, I had 3 winners in a row. That is my longest winning streak since I started reporting trades in the November series. Unfortunately, the points earned in this streak are very low. This kind of trading may improve my win %, but will screw up the Payoff Ratio. Details of trades so far are available on the Trading Stats page.

Another point that I should focus on is profit taking. On many days, I have had good MFE's, but my profit taking has been lax. Many times, even if I am in a loss, I do not book profit to get my account into green. That's because the only kind of exit that I have used in these trades are leisurely trailing stops. I will have to give this a thought, though I am very uncomfortable with Profit Taking. Also, I do not want to get into the complication of partial booking and adds.

Trade 1 was a bad exit... as happens always. My Initial SL was at Day High, but I moved it to the next bar high. Price came up to eat my SL, did not even touch Day High, and fell down. I thought of reentering short at 7995, but then decided that it would be overkill. If I had been in that trade, the light would have been brighter....

Otherwise, after 2 losses, I had 3 winners in a row. That is my longest winning streak since I started reporting trades in the November series. Unfortunately, the points earned in this streak are very low. This kind of trading may improve my win %, but will screw up the Payoff Ratio. Details of trades so far are available on the Trading Stats page.

Another point that I should focus on is profit taking. On many days, I have had good MFE's, but my profit taking has been lax. Many times, even if I am in a loss, I do not book profit to get my account into green. That's because the only kind of exit that I have used in these trades are leisurely trailing stops. I will have to give this a thought, though I am very uncomfortable with Profit Taking. Also, I do not want to get into the complication of partial booking and adds.

Tuesday, December 1, 2015

20151201 - Where does this tunnel end?

Still no light at the end of the tunnel. Particularly, I did not like my exit for Trade 3. Ranging market. Small box initially, then jumped around a bit due to some announcement, and then went ranging again.

Subscribe to:

Posts (Atom)