Today was a test of patience - the funny market just did not move for a long time. But

the only reason that it was such a test is because I was at the terminal all

the time... With mechanical trading systems, it might be better to

ignore the terminal the majority of the time. There's nothing much to be

done sitting there - everything is pre-decided.

Do the trades look stupid? Well, they were pre-decided to be that. That doesn't mean that the system is stupid. It's just mechanical. It doesn't use its brain in real time.

Will the trades look stupid over the long term? Well, if that's the case, then the system is stupid... like the brain behind it... it's early days to judge ☢

This December has been pretty bad for me.... Early days with my new SAR system. Hoping that Yuletide ☃ brings happy tidings.

Thursday, December 24, 2015

Wednesday, December 23, 2015

20151223 - Yawn! Boring Day

Nothing to write about today. A gap up, then continued the momentum for about an hour, and then just ranged for the rest of the day.

Tuesday, December 22, 2015

20151222 - Some wind in the sail...

So, here comes a small break in my losing saga....

The first trade was a slow moving one, but there was some wind in the sail with the second one.

Lazy day... had nothing much to do. That's an advantage of mechanical trading systems (on some days ☺).

The first trade was a slow moving one, but there was some wind in the sail with the second one.

Lazy day... had nothing much to do. That's an advantage of mechanical trading systems (on some days ☺).

Monday, December 21, 2015

20151221 - Default behavior

Today, I had a simple but tough-to-implement plan. But early on, when I did not get any entry signal with the plan, I fell back into my default behavior. My default behavior is find a set of rules that have a statistical or visual +ve expectancy, and trade it mechanically to death. Then when a whipsaw occurs, I begin the process all over again.

Today, I traded the "fewer trade" variation of the SAR system that I used on Friday, which meant that I missed the opening move.

Today, I traded the "fewer trade" variation of the SAR system that I used on Friday, which meant that I missed the opening move.

Labels:

Day Trades,

Futures,

Mechanical Trades,

NIFTY,

Trading Philosophy

Friday, December 18, 2015

20151218 - The Casino Effect

Today, I was busy with other stuff. Fully aware of the risks involved in mechanically trading SAR without being at terminal, I decided to play it with one lot....

There were 2 versions of this SAR system - one that trades more being SAR all the time, and the other that trades less by not being in trade all the time. Both are good and profitable over the LOOONG term. I chose the first one today. Today, was not the day. Even with 1 lot, it's a big loss.

I have tested n number of mechanical systems. Many of them are very profitable over the LOOONG term, but the drawdowns are severe (also when compared to discretionary systems). They have to be played for the long term, but the drawdowns limit the margins that can be utilized, and ultimately the returns for these systems.

So, until that series of big wins start pouring in with these systems, I trade with hope of that happening, just like in casinos. And when the series of big wins happen, margin utilization is increased, in the excitement of it all. Bet big until all is lost. Just like in casinos. End result: The system remains profitable in all backtests, not me.

There is no way that I cannot acknowledge that I have a problem to solve... What will I do about it? TBD.

There were 2 versions of this SAR system - one that trades more being SAR all the time, and the other that trades less by not being in trade all the time. Both are good and profitable over the LOOONG term. I chose the first one today. Today, was not the day. Even with 1 lot, it's a big loss.

I have tested n number of mechanical systems. Many of them are very profitable over the LOOONG term, but the drawdowns are severe (also when compared to discretionary systems). They have to be played for the long term, but the drawdowns limit the margins that can be utilized, and ultimately the returns for these systems.

So, until that series of big wins start pouring in with these systems, I trade with hope of that happening, just like in casinos. And when the series of big wins happen, margin utilization is increased, in the excitement of it all. Bet big until all is lost. Just like in casinos. End result: The system remains profitable in all backtests, not me.

There is no way that I cannot acknowledge that I have a problem to solve... What will I do about it? TBD.

Labels:

Day Trades,

Disaster,

Futures,

Mechanical Trades,

NIFTY,

Trading Philosophy

Thursday, December 17, 2015

20151217 - Stayed out of the Chop... Missed the Fluid

Just one of those days.... that seems to happen to me daily. I got excuses for everything...

Day started off with a BOF of 7800. I thought about taking it, but then decided to wait. Then I watched it making lower highs.

Trade 1 was a long on BOF of 7750. Price chopped around, but I managed to stay out of the chop. As market broke out of chop, I anticipated that it would come back in range and shorted (Trade 2). It was a wrong guess, so I reversed to long again (Trade 3). I tightened the Stop just to allow the market to take it (actually, I didn't want a bigger loss). My SL was 7768.50, and price dipped to EXACTLY that before zooming up.

I watched it zoom, but I was not done yet. There was an inside bar at the morning high 7810, and I tried to short it. Luckily, the trade missed me :) It would have been a good pullback trade, if I had thought long.

The last trade was done hoping that the market had run out of steam, as happens on some days towards the end of day. I had no clue about why price zoomed up, until the EOD, I looked up the news to find that it's something to do with yesterday's Fed rate hike, that Indian markets didn't know what to do about until the European markets started moving.

Today, I went a step ahead, and broadcast my trades even before taking them. Whether I am doing good at my trading or not, I am doing better at broadcasting it. All my live tweets are on the Twitter widget on the right pane of the web page. Have a look...

Here's a zoomed-in image of the whipsaw, that is not clear on the chart above.

Day started off with a BOF of 7800. I thought about taking it, but then decided to wait. Then I watched it making lower highs.

Trade 1 was a long on BOF of 7750. Price chopped around, but I managed to stay out of the chop. As market broke out of chop, I anticipated that it would come back in range and shorted (Trade 2). It was a wrong guess, so I reversed to long again (Trade 3). I tightened the Stop just to allow the market to take it (actually, I didn't want a bigger loss). My SL was 7768.50, and price dipped to EXACTLY that before zooming up.

I watched it zoom, but I was not done yet. There was an inside bar at the morning high 7810, and I tried to short it. Luckily, the trade missed me :) It would have been a good pullback trade, if I had thought long.

The last trade was done hoping that the market had run out of steam, as happens on some days towards the end of day. I had no clue about why price zoomed up, until the EOD, I looked up the news to find that it's something to do with yesterday's Fed rate hike, that Indian markets didn't know what to do about until the European markets started moving.

Today, I went a step ahead, and broadcast my trades even before taking them. Whether I am doing good at my trading or not, I am doing better at broadcasting it. All my live tweets are on the Twitter widget on the right pane of the web page. Have a look...

Here's a zoomed-in image of the whipsaw, that is not clear on the chart above.

Labels:

Day Trades,

Discretionary Trades,

Futures,

NIFTY

Wednesday, December 16, 2015

20151216 - Buying Tops and Selling Bottoms

Finally, after many days, I got the time to sit in front of the terminal... but it was not a good time. ☹

All 3 trades were losers.

Trade 1 was taken on the low of the second M15 bar - which was an inside bar - in the hope of a down move. Trade 2 was taken on the hope of a breakout move. For this trade, I should perhaps have tightened the SL, maybe? Trade 3 was BOF of HOD. Got shaken out.

All the hoping was hopeless. All I was doing today was buying tops and selling bottoms.

All 3 trades were losers.

Trade 1 was taken on the low of the second M15 bar - which was an inside bar - in the hope of a down move. Trade 2 was taken on the hope of a breakout move. For this trade, I should perhaps have tightened the SL, maybe? Trade 3 was BOF of HOD. Got shaken out.

All the hoping was hopeless. All I was doing today was buying tops and selling bottoms.

Labels:

Day Trades,

Discretionary Trades,

Futures,

NIFTY

Friday, December 11, 2015

20151211 - Nothing goes right

I was a bit over-patient in the morning, then impatient in the second half. Nothing is going right for me.... Analysis time.

I have not updated the Trading Stats since yesterday. I will get around to that later. When you keep on losing, everything else seems a futile exercise.

I have not updated the Trading Stats since yesterday. I will get around to that later. When you keep on losing, everything else seems a futile exercise.

Labels:

Day Trades,

Discretionary Trades,

Futures,

NIFTY

Thursday, December 10, 2015

Time to take a break

Time to take a break from trading and analyze. next update only after that.

https://t.co/SWTAnsvfCz #NIFTY #Daytrading #TechnicalAnalysis

— Bakwaas Trading (@BakwaasTrading) December 10, 2015Wednesday, December 9, 2015

20151209 - Back on familiar (mechanical) turf

In the morning, did 2 discretionary trades. Pretty bad trades. Seemed I am not in sync with the market (surprising!), so I switched to mechanical trades. Those didn't work out either. I had MFE of +19 and +20 on the mechanical trades, but the mechanical rules did not permit me to book.... The other reason for switching to mechanical is that I am not able to spend much in front of the terminal this week, due to some other work.

Kinda stupid to log losses and broadcast to the world, but I have decided to continue this for at least this month. Let's see.... Tomorrow is another day...

Kinda stupid to log losses and broadcast to the world, but I have decided to continue this for at least this month. Let's see.... Tomorrow is another day...

Labels:

Day Trades,

Discretionary Trades,

Futures,

Mechanical Trades,

NIFTY

Tuesday, December 8, 2015

20151208 - Making bad luck out of good luck

From 11 AM onward, I was hardly available at the terminal today. I traded despite that. You could say that I was trading blind. For all my exertions, all I got is the usual downer. I got 11 points from 5 trades today +15, -7, +1, -4 and +6. Yesterday, I had 8 points from 6 trades. *All pre-brokerage points

Trade 1 exit was unlucky. The SL hit when I was away from the terminal.

I was also away when the Trade 2 entry happened. Was lucky to have been able to exit (SAR), just before the spike up. Then, I lost an opportunity to lock few points in Trade 3.

Trades 4 and 5, that happened during the last hour fall, were worse - they resulted from typos. My fingers ☹ slipped on the keyboard or something .... I don't know what happened, I was not focused. I clicked something on my keyboard, and thought that I had gone long at 7755, when in reality it was the exit from a short position that I had created without even realizing it (maybe from another typo...). So, when I thought I was exiting my long at 7746, I was actually creating a new short position. Then, just as I was about to close the terminal, I realized that I was short, and placed a tight SL which got hit. Which means that I had the good luck of being short twice in the fall with small risk (without even realizing it), and the bad luck of exiting those positions for nothing. Confusing? Sure, even I deciphered these trades only after EOD.

All of this was updated live on my twitter timeline - available on the right panel of this web page.

Since I shifted to discretionary trading this month, I have not had any big losses. So, I will keep playing this system, though the System Hopping itch is creeping in.

Trade 1 exit was unlucky. The SL hit when I was away from the terminal.

I was also away when the Trade 2 entry happened. Was lucky to have been able to exit (SAR), just before the spike up. Then, I lost an opportunity to lock few points in Trade 3.

Trades 4 and 5, that happened during the last hour fall, were worse - they resulted from typos. My fingers ☹ slipped on the keyboard or something .... I don't know what happened, I was not focused. I clicked something on my keyboard, and thought that I had gone long at 7755, when in reality it was the exit from a short position that I had created without even realizing it (maybe from another typo...). So, when I thought I was exiting my long at 7746, I was actually creating a new short position. Then, just as I was about to close the terminal, I realized that I was short, and placed a tight SL which got hit. Which means that I had the good luck of being short twice in the fall with small risk (without even realizing it), and the bad luck of exiting those positions for nothing. Confusing? Sure, even I deciphered these trades only after EOD.

All of this was updated live on my twitter timeline - available on the right panel of this web page.

Since I shifted to discretionary trading this month, I have not had any big losses. So, I will keep playing this system, though the System Hopping itch is creeping in.

Labels:

Day Trades,

Discretionary Trades,

Futures,

NIFTY

Monday, December 7, 2015

20151207 - Too many hasty entries today

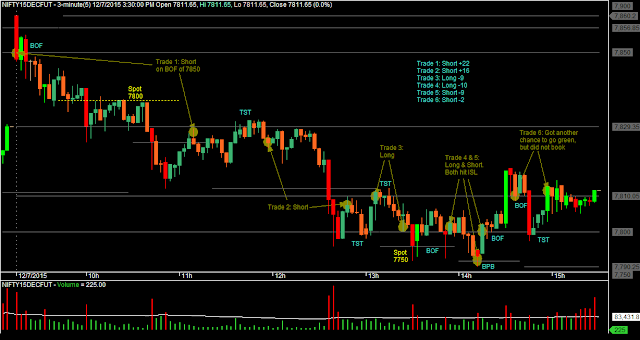

Today was going well with decent wins in the first half, but turned a disaster with a string of losses in the second half. At the end of the day, I got nothing.

Many of the entries were hasty, I guess, though I am not sure. To a large extent, I tried to base my entries on the Decision Point Trading method that is explained on the Nifty Nirvana blog (link to download the free e-book on that site), but I am not doing it right.... The author does not take as many entries as I do.

Other than the entries, the rest of my trading today was mechanical trailing. One of my issues with discretionary trading is that I never know whether I did it right or wrong, which is almost what these methods are, by definition.

Again, I did not trail SL early, because that was my mechanical rule for the day. If I had trailed early, I would have lost less in the losing trades, but then Trade 2 would also have been a loss....

Many of the entries were hasty, I guess, though I am not sure. To a large extent, I tried to base my entries on the Decision Point Trading method that is explained on the Nifty Nirvana blog (link to download the free e-book on that site), but I am not doing it right.... The author does not take as many entries as I do.

Other than the entries, the rest of my trading today was mechanical trailing. One of my issues with discretionary trading is that I never know whether I did it right or wrong, which is almost what these methods are, by definition.

Again, I did not trail SL early, because that was my mechanical rule for the day. If I had trailed early, I would have lost less in the losing trades, but then Trade 2 would also have been a loss....

Labels:

Day Trades,

Decision Point Trading,

Discretionary Trades,

Futures,

NIFTY

Friday, December 4, 2015

20151204 - Down Day

Yesterday, I thought that I was intelligent. Today, I longer have that pretension. Yesterday, I talked about having low MAE's - but today, the MFE's were low, except for the 4th trade. The MFE's for the 5 trades done today were +0.15, +4.00, +1.50, +29.45 and +6.50

Some of my entries were perhaps a bit hasty. As usual, such facts are always much clearer at the end of the day.

Some of my entries were perhaps a bit hasty. As usual, such facts are always much clearer at the end of the day.

Labels:

Day Trades,

Discretionary Trades,

Futures,

NIFTY

Thursday, December 3, 2015

20151203 - Finally, a decent profit day after a long time!!

Today was a good day, or as I call it - a lucky day. 3 trades, and I think all of them were good. Profit taking - something that I can always complain about - not too bad.

The last 2 trades zoomed into profit, so there was not much to do on those. One took an hour for 17 points, and the other 45 minutes for 48 points. The first trade took 2 hours and 45 minutes for a small loss. That one was more tricky than the others, and I had marked a channel for Price to move along, but it deviated and fell down and had to get up all over again ☺. Note that I could have locked in a small profit on it anytime, but I chose to be wiser (or sillier) - I don't know which was it.

My last 6 trades have been: +15, +9, +12, -1, +17 and +48. That's good, but what I am really happy about is the MAE's on these trades. Those are 0.00, 0.00, -0.60, -2.60, -2.55 and -2.20 ☻. Am I intelligent or what?

MAE = Most Adverse Excursion

The last 2 trades zoomed into profit, so there was not much to do on those. One took an hour for 17 points, and the other 45 minutes for 48 points. The first trade took 2 hours and 45 minutes for a small loss. That one was more tricky than the others, and I had marked a channel for Price to move along, but it deviated and fell down and had to get up all over again ☺. Note that I could have locked in a small profit on it anytime, but I chose to be wiser (or sillier) - I don't know which was it.

My last 6 trades have been: +15, +9, +12, -1, +17 and +48. That's good, but what I am really happy about is the MAE's on these trades. Those are 0.00, 0.00, -0.60, -2.60, -2.55 and -2.20 ☻. Am I intelligent or what?

MAE = Most Adverse Excursion

Labels:

Day Trades,

Discretionary Trades,

Futures,

NIFTY

Wednesday, December 2, 2015

20151202 - A dim light... could have been brighter

Finally, a small profit... but could have been better.

Trade 1 was a bad exit... as happens always. My Initial SL was at Day High, but I moved it to the next bar high. Price came up to eat my SL, did not even touch Day High, and fell down. I thought of reentering short at 7995, but then decided that it would be overkill. If I had been in that trade, the light would have been brighter....

Otherwise, after 2 losses, I had 3 winners in a row. That is my longest winning streak since I started reporting trades in the November series. Unfortunately, the points earned in this streak are very low. This kind of trading may improve my win %, but will screw up the Payoff Ratio. Details of trades so far are available on the Trading Stats page.

Another point that I should focus on is profit taking. On many days, I have had good MFE's, but my profit taking has been lax. Many times, even if I am in a loss, I do not book profit to get my account into green. That's because the only kind of exit that I have used in these trades are leisurely trailing stops. I will have to give this a thought, though I am very uncomfortable with Profit Taking. Also, I do not want to get into the complication of partial booking and adds.

Trade 1 was a bad exit... as happens always. My Initial SL was at Day High, but I moved it to the next bar high. Price came up to eat my SL, did not even touch Day High, and fell down. I thought of reentering short at 7995, but then decided that it would be overkill. If I had been in that trade, the light would have been brighter....

Otherwise, after 2 losses, I had 3 winners in a row. That is my longest winning streak since I started reporting trades in the November series. Unfortunately, the points earned in this streak are very low. This kind of trading may improve my win %, but will screw up the Payoff Ratio. Details of trades so far are available on the Trading Stats page.

Another point that I should focus on is profit taking. On many days, I have had good MFE's, but my profit taking has been lax. Many times, even if I am in a loss, I do not book profit to get my account into green. That's because the only kind of exit that I have used in these trades are leisurely trailing stops. I will have to give this a thought, though I am very uncomfortable with Profit Taking. Also, I do not want to get into the complication of partial booking and adds.

Labels:

Day Trades,

Discretionary Trades,

Futures,

NIFTY

Tuesday, December 1, 2015

20151201 - Where does this tunnel end?

Still no light at the end of the tunnel. Particularly, I did not like my exit for Trade 3. Ranging market. Small box initially, then jumped around a bit due to some announcement, and then went ranging again.

Labels:

Day Trades,

Discretionary Trades,

Futures,

NIFTY

Monday, November 30, 2015

20151130 - Discretionary Trades today

Today, I system hopped once again. This time to discretionary trading. The losing steak continues nevertheless.

4 trades with 3 losses, and no decent winner. There could have been a couple of entries that would have been profitable, IF taken.... but I only "thought" about taking those. The first trade, the Long, was a typo. I went long instead of short, and hence SAR'ed when the Stop hit.

The marked-up chart may look cluttered, but perhaps would make better sense when taken in conjunction with my live tweets.

4 trades with 3 losses, and no decent winner. There could have been a couple of entries that would have been profitable, IF taken.... but I only "thought" about taking those. The first trade, the Long, was a typo. I went long instead of short, and hence SAR'ed when the Stop hit.

The marked-up chart may look cluttered, but perhaps would make better sense when taken in conjunction with my live tweets.

Labels:

Day Trades,

Discretionary Trades,

Futures,

NIFTY

Sunday, November 29, 2015

The Value of Nothing

Really??! It's just a big stone. Give that diamond to us speculators, and we will find it's value. We will bid and ask different prices, but we will find the value. We don't really care about the value, but we will find a Price. Price is what matters to speculators.

Why is a diamond valuable? (Actually, why is anything valuable?, but we will address that bigger question later.)

When we were kids, we used to collect those nice smooth or shiny pebbles, didn't we? And cry if we lost a pebble, fight for it, protect it, steal it? But then we grew up..... and realised that stuff wasn't worth much.

Guess what. Mankind still has to grow up. We still strive to own these useless pieces of stones and metals (they do have industrial uses and we can throw them at wild animals when they attack us, but that is not what we value them for).

Settlers could rob natives of things like land and country (and people/slaves), in exchange for bright beads and clothes, because the natives valued those beads... and not iPhones. Unlike those natives, we value money, those pieces of paper, metal coins, IOU notes, virtual money (as if the rest is not virtual), because we believe a goverment or something has guaranteed their value - when most of the time there are no assets to back them. Random names/places/animals/things are valued, and sometimes worshipped.

Monkeys don't value those stones as much as us. That gets me thinking... maybe our society/civilization is built or based on stuff that I think don't have value. Don't we value our culture/civilization? If we stop valuing a random stuff that we value now, then that basis of our society/culture/civilization will change.

Diamonds and modern art will continue to be valued by society for more than a generation. People who fight to own them will not appear as silly as the children who grew up, because society will not grow up enough in their lifetime. Could the value disappear in a generation?.... then they would look silly like those who were in the Tulip mania or Dot Com mania or the craze for a Justin Timberlake ticket?

Friday, November 27, 2015

The Power of Compounding

Yes, it's the very same thing that we all learned in school. However, in the heat of trading, we tend to forget this simple principle. So, here's a reminder. Consistently earning even a few points everyday will make a trader rich.

Below, I am pasting verbatim what I posted on the topic on my thread in Traderji. Note the need to deploy full capital to get the results indicated. As mentioned in the post, a high win % and low risk per trade would be great. However, I am now thinking that high Recovery Factor and low risk per trade would be a better criteria to give the confidence to deploy maximum capital.

Recovery Factor = (Net profit) / (Maximum system drawdown)

Below, I am pasting verbatim what I posted on the topic on my thread in Traderji. Note the need to deploy full capital to get the results indicated. As mentioned in the post, a high win % and low risk per trade would be great. However, I am now thinking that high Recovery Factor and low risk per trade would be a better criteria to give the confidence to deploy maximum capital.

Recovery Factor = (Net profit) / (Maximum system drawdown)

| The Power of Compounding NF is at 7700. If you are able to net 10 points per day, then you are earning 3.24% on margin on MIS basis, and 1.62% on NRML basis. If you have a high win %, and low risk per trade, and deploy full capital on each trade, then with NRML your capital would have multiplied 24 time in an year. With MIS, then your capital would have multiplied 588 times. I am assuming that you are able to trade 200 days in a year. If you earn 0.1% of capital everyday, compounding your capital will make it 1.22 times after 1 year. If 0.2%, 1.49 times. If 0.3%, 1.82 times. If 0.5%, 2.71 times. If 1%, 7.32 times. If 2%, 52 times. If 3%, 369 times. If 4%, 2550 times. If 5%, 17292 times. If 6%, 115125 times. If 7%, 752931 times. If 8%, 4838949 times. If 9%, 30570292 times. If 10%, 189905276 times. Get the drift? Now don't find excuses. Just do it |

Labels:

Money Management,

Traderji,

Trading Philosophy

20151127 - Bad run continues...

This bad run is taking a long time. See chart below... I have to do something about reducing the number of entries.

Thursday, November 26, 2015

20151126 - End of the series... not a great one

This week has not been good at all. In comparison to last week, it has been boring.

Today, took 3 trades, and lost all of them. It was expiry day, but there was no great movement in the market.

Pre-brokerage, I made 170 points from 55 trades in this series. That is down 59 points from the peak of 229 points on Nov 18th. Looking at the daily stats shown below, it is clear that I could have done so much better if I had avoided losing big time on an unidirectional day like Nov 19. Regrets and all that, but..... My costs are approximately 1.55 points per trade - so that's not many points earned in the current series that had some really good movements.

I am wishing myself luck for the next series, and hope to continue blogging and live tweets (it's not motivating to report losses ☹). I plan to include the trades for the next series in the current spreadsheet. The complete report of my trades in this series is available on the Trading Stats page.

Today, took 3 trades, and lost all of them. It was expiry day, but there was no great movement in the market.

Pre-brokerage, I made 170 points from 55 trades in this series. That is down 59 points from the peak of 229 points on Nov 18th. Looking at the daily stats shown below, it is clear that I could have done so much better if I had avoided losing big time on an unidirectional day like Nov 19. Regrets and all that, but..... My costs are approximately 1.55 points per trade - so that's not many points earned in the current series that had some really good movements.

I am wishing myself luck for the next series, and hope to continue blogging and live tweets (it's not motivating to report losses ☹). I plan to include the trades for the next series in the current spreadsheet. The complete report of my trades in this series is available on the Trading Stats page.

| Daily Statistics of the November series |

Tuesday, November 24, 2015

20151124 - Another Bakwaas Day

That's Strike II. 4 trades with only one small winner. This time it's a loss on both gross and net basis.

Trade 1 was a long one (duration-wise). I was in that trade for 2 hours and 18 minutes. MFE for the trade was only 13 points, and I booked a loss of 7 points on it. A good data point to add to the Holding Period Analysis that I had done last Wednesday. Another way to look at it is that I was lucky to be in that trade during that sideways zone. If not, I would have probably entered multiple losing trades during that same sideways period. ☺

Trade 3 went into profit with a sudden fall, and reversed just as quickly. Out of a MFE 41, I booked 24 points. That's better than the 50% booking rule that I had at the start of this series.

Also, completed 50th trade of this series today. Statistics available on my Trading Stats page.

Trade 1 was a long one (duration-wise). I was in that trade for 2 hours and 18 minutes. MFE for the trade was only 13 points, and I booked a loss of 7 points on it. A good data point to add to the Holding Period Analysis that I had done last Wednesday. Another way to look at it is that I was lucky to be in that trade during that sideways zone. If not, I would have probably entered multiple losing trades during that same sideways period. ☺

Trade 3 went into profit with a sudden fall, and reversed just as quickly. Out of a MFE 41, I booked 24 points. That's better than the 50% booking rule that I had at the start of this series.

Also, completed 50th trade of this series today. Statistics available on my Trading Stats page.

| NIFTY M3 Candlestick Chart |

| NIFTY M15 Candlestick Chart |

Monday, November 23, 2015

Friday, November 20, 2015

20151120 - Roller coaster week

Monday: +70 points from 3 trades

Tuesday: +3 points from 4 trades

Wednesday: +98 points from 2 trades

Thursday: -72 points from 7 trades

Friday: +33 points from 4 trades

*Points are pre-brokerage

It was a happy week, except for the scary jolt on Thursday. This always happens when I trade mechanically. Every once in a while, a day comes that make me lose confidence.

The SL hit on today's trade 4 was just too bad. My SL for the short was 7908. Price came to EXACTLY that point and reversed. This stuff keeps happening all the while with this system.

The M3 chart below is what I was live tweeting throughout the day. I live tweeted today. Follow me on my twitter handle @BakwaasTrading. I have also added a live tweet widget to the right pane of this blog. Check it out, though I cannot promise that I will keep live tweeting every day.

Tuesday: +3 points from 4 trades

Wednesday: +98 points from 2 trades

Thursday: -72 points from 7 trades

Friday: +33 points from 4 trades

*Points are pre-brokerage

It was a happy week, except for the scary jolt on Thursday. This always happens when I trade mechanically. Every once in a while, a day comes that make me lose confidence.

The SL hit on today's trade 4 was just too bad. My SL for the short was 7908. Price came to EXACTLY that point and reversed. This stuff keeps happening all the while with this system.

The M3 chart below is what I was live tweeting throughout the day. I live tweeted today. Follow me on my twitter handle @BakwaasTrading. I have also added a live tweet widget to the right pane of this blog. Check it out, though I cannot promise that I will keep live tweeting every day.

Thursday, November 19, 2015

20151119 - Disaster!!!

Karma homed in today, and exposed all that is bad about this system. 7 trades - all losses - at an average of -10.53 pre-brokerage points per loss. The trend was all one way up, but the current system rules do not bother about that.

Given up everything that I earned yesterday, small consolation that the biggest loss of the series so far happened right after the biggest win.

Almost time to scrap this system, but I plan to give it another try, maybe with whatever small modifications I can think of.

What next????

Given up everything that I earned yesterday, small consolation that the biggest loss of the series so far happened right after the biggest win.

Almost time to scrap this system, but I plan to give it another try, maybe with whatever small modifications I can think of.

What next????

Labels:

Day Trades,

Disaster,

Futures,

Mechanical Trades,

NIFTY

Wednesday, November 18, 2015

Data Analysis: Holding Period and Profit Locking

Here's some analysis of the holding period of my trades vs. the actual and potential profits.

31 trades so far in this series, 9 of them profitable.

Relation between holding period and profit:

Of the profitable ones, only 1 had a holding period of less than 60 minutes - trade 3 on Tuesday.

94% of the trades held for less than 60 minutes resulted in losses. So, is it anything of significance? I guess not. I think it is just that I did not get into any trades that zoomed into profits and reversed significantly within an hour. Lazy Nifty!

Amount of profit locked:

For the profitable trades, the average MFE is 63 points, and on average I have booked 45 points out of them. Not bad!

For losing trades of less than 60 minutes duration, the average MFE is 8 points, and on average I have made a loss of 9 points on them. That's nearly OK for the kind of system that I am trading.

But for losing trades of more than 60 minutes duration (there were 6 such trades), the average MFE is 21 points, and the average loss is 7 points. This is certainly a concern. On the average, here I am giving up 28 points to book a loss. I hope that the aggressive profit locking that I adopted this week will improve this statistic. As usual, this aggressive profit locking will also have negative impact in terms of shake outs, and probably increase the number of trades.

The system will continue to be modified (and over-analyzed) or may even be discarded to balance out all the pros and cons. Never ending process...

Glossary: MFE stands for Most Favorable Excursion, which means the most profitable point during the duration of a trade. See the definition at MyPivots.

31 trades so far in this series, 9 of them profitable.

Relation between holding period and profit:

Of the profitable ones, only 1 had a holding period of less than 60 minutes - trade 3 on Tuesday.

94% of the trades held for less than 60 minutes resulted in losses. So, is it anything of significance? I guess not. I think it is just that I did not get into any trades that zoomed into profits and reversed significantly within an hour. Lazy Nifty!

Amount of profit locked:

For the profitable trades, the average MFE is 63 points, and on average I have booked 45 points out of them. Not bad!

For losing trades of less than 60 minutes duration, the average MFE is 8 points, and on average I have made a loss of 9 points on them. That's nearly OK for the kind of system that I am trading.

But for losing trades of more than 60 minutes duration (there were 6 such trades), the average MFE is 21 points, and the average loss is 7 points. This is certainly a concern. On the average, here I am giving up 28 points to book a loss. I hope that the aggressive profit locking that I adopted this week will improve this statistic. As usual, this aggressive profit locking will also have negative impact in terms of shake outs, and probably increase the number of trades.

The system will continue to be modified (and over-analyzed) or may even be discarded to balance out all the pros and cons. Never ending process...

Glossary: MFE stands for Most Favorable Excursion, which means the most profitable point during the duration of a trade. See the definition at MyPivots.

20151118 - Dropped catches in my century today!!!

Today, luck was with me. Since Monday, when I moved to the M5 chart, and tightened the Stops, shake outs (bad luck) have been affecting. The market pulls back just to eat my SL and then continues on its way... See the trade 2 on Monday and almost all exits on Tuesday.

Not so today. The price came within 1 point of my SL 4 times but did not touch them. Finally, I have a century in this series with the help of all those dropped catches!!!

I have no clue about why the market fell. I don't really follow the news, I follow only my system. The advantage of a mechanical trading system is that you get plenty of free time, since you don't need to analyze the price moves in real time. Unfortunately, I do not do anything useful with all that free time.

Not so today. The price came within 1 point of my SL 4 times but did not touch them. Finally, I have a century in this series with the help of all those dropped catches!!!

I have no clue about why the market fell. I don't really follow the news, I follow only my system. The advantage of a mechanical trading system is that you get plenty of free time, since you don't need to analyze the price moves in real time. Unfortunately, I do not do anything useful with all that free time.

Labels:

Century,

Day Trades,

Futures,

Mechanical Trades,

NIFTY

Tuesday, November 17, 2015

20151117 - Back to my losing ways...

Many shakeouts today due to the tight SL's. I think the price reacted ok at DP's.

What should I do next?

What should I do next?

Monday, November 16, 2015

20151116 - Losing streak broken!!!

Changed the rules to be more aggressive - which means that I traded off the 5 minute chart, with tighter Stop Losses. I expect that with these rules there will be many more trades, and lot of SL hit shake-outs, but I will lock in a higher percentage of profits than last week.

Today's Trade 2 was one of those unfortunate shake-outs.

The day ended happy - the best day for me in this series. Good recovery. Almost wiped out the drawdown. In post-brokerage terms, I still need about 12 points to get back to my peak equity this series.

But finally I have a winning streak - 2 consecutive wins today. Another point is that all 3 trades done today were long. In fact, 5 of the last 6 trades have been long... so is it longing season, as opposed to Shorting Season?

Today's Trade 2 was one of those unfortunate shake-outs.

The day ended happy - the best day for me in this series. Good recovery. Almost wiped out the drawdown. In post-brokerage terms, I still need about 12 points to get back to my peak equity this series.

But finally I have a winning streak - 2 consecutive wins today. Another point is that all 3 trades done today were long. In fact, 5 of the last 6 trades have been long... so is it longing season, as opposed to Shorting Season?

Friday, November 13, 2015

20151113 - Did (Could) not lock profits

3 trades. All losses.

MFE: +17, +29, +25 Booked: -6, -5, -0

Could not lock profits because of the system rules. I had tweaked the system a bit for today, but I guess it was not good enough. DP trading would have done better today....

So, the losing streak continues....

MFE: +17, +29, +25 Booked: -6, -5, -0

Could not lock profits because of the system rules. I had tweaked the system a bit for today, but I guess it was not good enough. DP trading would have done better today....

So, the losing streak continues....

Tuesday, November 10, 2015

20151110 - Losing streak continues

1 win and 2 losses. The smallest of all wins in this series, and biggest of all losses in this series. From the data, I can see that the max. MAE of winners has been -7.1 points, so keeping 15 points initial SL may not be worth it... but the data set of trades so far is small.

Time to make changes to the system....

Time to make changes to the system....

Labels:

Data Analysis,

Day Trades,

Futures,

Mechanical Trades,

NIFTY

Monday, November 9, 2015

20151109 - Completely missed the move

A good up day. Perhaps the best intraday move in this series so far, and I got my biggest daily loss of the series....

Friday, November 6, 2015

Thursday, November 5, 2015

20151105 Shorting Season

It's shorting season. I shorted 3 times today for 2 losses and 1 win.

I have done 12 trades in this series so far. Out of these 10 (83%) have been shorts. Both my longs have been losers. Of the shorts, 4 (40%) have been winners. 4 (80%) of the daily bars are red and one is doji. So, it's good that my entries are in sync with the market. (I always have a tendency to attribute these things to luck.) If only the win rate was better....

I have done 12 trades in this series so far. Out of these 10 (83%) have been shorts. Both my longs have been losers. Of the shorts, 4 (40%) have been winners. 4 (80%) of the daily bars are red and one is doji. So, it's good that my entries are in sync with the market. (I always have a tendency to attribute these things to luck.) If only the win rate was better....

Labels:

Data Analysis,

Day Trades,

Futures,

Mechanical Trades,

NIFTY

Subscribe to:

Posts (Atom)