Today, I logged in early again in an attempt to replicate my success with Opening Range Breakout yesterday. I found the opening move in State Bank Of India to be impressive, and went short with it. But my Initial Stop Loss was tight and got hit. I had wanted to keep a Stop-and-Reverse to long at that point, but did not have sufficient margin. Such potential early morning whipsaws are the reason why I was logging in late prior to yesterday.

Anyway, if I had stayed on with State Bank Of India, I would have ridden the second breakdown successfully, but that was not to be.

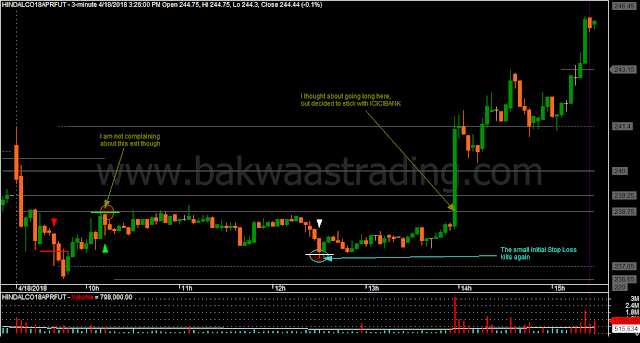

I was already into Hindalco. My 2 trades in Hindalco did not give me much.

After that, I was back to State Bank Of India. I thought that my late short in State Bank would help me get into profits, but that was not to be. Actually, I was in profit in that trade, but the wide Trailing Stop Loss required by the One Good Trade rule, prevented locking any profits in it.

Anyway, if I had stayed on with State Bank Of India, I would have ridden the second breakdown successfully, but that was not to be.

I was already into Hindalco. My 2 trades in Hindalco did not give me much.

After that, I was back to State Bank Of India. I thought that my late short in State Bank would help me get into profits, but that was not to be. Actually, I was in profit in that trade, but the wide Trailing Stop Loss required by the One Good Trade rule, prevented locking any profits in it.

|

| Day Trading Price Action SBIN |

|

| Day Trading Price Action HINDALCO |

>>> My live tweets of today's trades <<<