I am not used to trading Stock Futures. Over the years, I have been focused on on trading NIFTY Futures and Options. Rarely, do I trade Stocks or Commodities.

Today, I did not even once check the Nifty Chart. I had my watchlist of Stock Futures. I wanted to focus only on one scrip at a time. So, it turned out to be a kind of rolodex, where I traded each Stock Future in turn.

JUBLFOOD (Jubilant Foodworks)

Was in a bit of a hurry to get on with today's trades. Bad decision (in hindsight). After a whipsaw, managed to pull in some profit with my 4th trade. Then, I thought that Jindal Steel was interesting and shifted focus.

|

| Day Trading Price Action JUBLFOOD |

TATASTEEL (Tata Steel)

There was a mismatch between the price in my data feed and the price on my trading terminal. In the confusion, I had to let go a short that was probably a good opportunity. I did not chase that short and shifted back to Jubilant Foods.

|

| Day Trading Price Action TATASTEEL |

JINDALSTEL (Jindal Steel & Power)

There was this news about increased steel production and sales by Jindal Steel. I thought that the news was bullish. But when the stock did not react, I was tempted to go short.

|

| Day Trading Price Action JINDALSTEL |

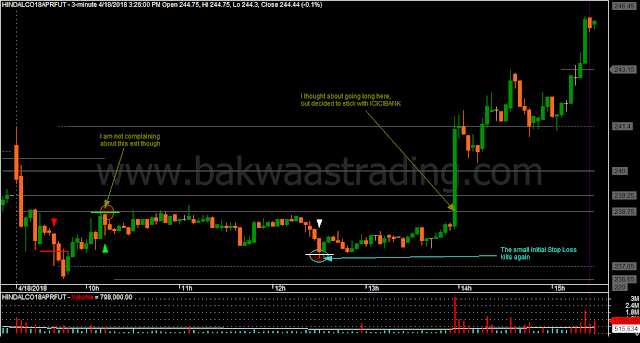

ICICIBANK (ICICI Bank)

Caught a very small part of the breakout.

|

| Day Trading Price Action ICICIBANK |

SBIN (State Bank Of India)

This one gave me a grand whipsaw, and I could not recover from it.

|

| Day Trading Price Action SBIN |