Got back to trading after a break on Monday. Was a decent day today.

Traded two scrips - SBIN and TATAMOTORS - and managed to be in-the-money on both.

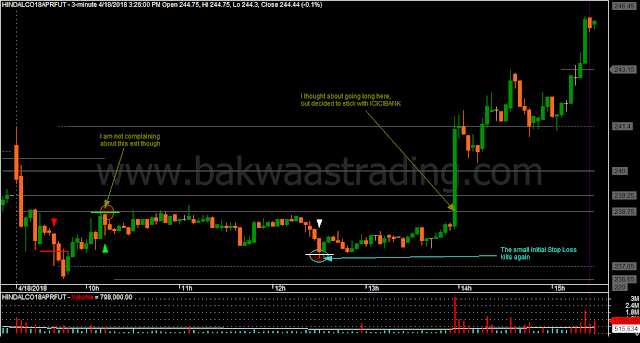

Started the day with 2 trades in Tata Motors. Scratched both those trades, though there was some profit in both. After that, I thought that Tata Motors might range, and decided to wait for either a Break Out or Break Out Failure at Range Extremes. However, in the meantime, I entered short in State Bank Of India, and so missed the fall in Tata Motors.

While Tata Motors fell, I was locked in my Short position in State Bank Of India, which did not move for quite sometime. But finally, it did fall, and I locked in some profit and reversed to long. I am experimenting with keeping the Initial Stop Loss small - sometimes smaller than what

the One Good Trade rule would demand. More whipsaws are expected with smaller Stop Losses, and that is what happened to my long trade in State Bank Of India.

The final trade was a Long in Tata Motors above a congestion. That did not move much.

The whole of last week, I had been focusing on Trailing Stop Losses, and the result was

the One Good Trade rule. While that rule has not yet caught any super duper trade for me, it has reduced the number of whipsaws and improved my performance.

Now, I am thinking about ways to reduce the Initial Stop Loss. If a wide Initial Stop Loss is hit, it takes away a considerable part of my profits every time, and I don't like that.

Now what should I do about it?

|

| Day Trading Price Action TATAMOTORS |

|

| Day Trading Price Action SBIN |